Last updated 8/19/2021.

What percentage does eBay take? Usually 12.55% (not 10% like it used to). But that's just one of the fees you'll face. What you should really be asking is, what does it cost to sell on eBay?

There are tons of hidden costs involved in selling on eBay. If you don’t know about them, you could lose money on items you thought would turn a profit.

We provide a quick explanation of the costs in “Selling on eBay for Beginners: 5 Steps to Success.” That’s a good place to learn the basics of how the fees are calculated. This article, though, is for those who want to go deeper.

Final Value Fees (eBay's Percent of Every Sale)

Short version: eBay takes a percentage of almost all sales, ranging from 1.5% to 15%.

eBay's final value fees are often the largest single cost for sellers. They're taken as a percentage of the amount actually charged to the customer. That includes the item price, the shipping cost, and any sales tax. (One small break: If the buyer chooses international or 1-day shipping, you're charged as if the shipping cost was your cheapest domestic option.)

The percentage depends first on whether you use managed payments. This is the default for new sellers, and all other sellers will be required to switch to managed payments by the end of 2021. You can find the final value fees for managed payments sellers here and for non-managed here.

Next, it depends on the category you're selling in and whether you have an eBay Store. Following is a quick overview of what you might have to pay on each sale. If you know what you want to sell, take notes—we'll get to calculating your total fees later on.

With no Store or a Starter Store (managed payments in bold / not managed in italics / same for both in standard text):

- 15% / 12.85% on watches.

- 14.55% / 12.2% on books, magazines, movies, TV, and most music.

- 12.55% / 10.2% for most listings.

- 12.35% on bullion and on trading/collectible cards.

- 5.85% / 3.5% on guitars and basses.

- 5% on NFTs.

- 3% / 2% on some Business & Industrial categories.

- 0% on athletic shoes with a starting price of at least $100.

Note that on managed payments, most categories have tiered pricing structures. For example, if you sell an item worth more than $7,500, the fees often drop to 2.55%. On non-managed payments, there are usually fee limits instead, generally $750 as the max fee.

With a Basic or Premium Store (managed payments / not managed):

- Thresholds for lower fees on high-value items reduced, usually from item values of $7,500 to $2,500. / Maximum final value fee of $350 on most categories, with a $250 maximum on Guitars & Basses and some Business & Industrial categories.

- 14.55% / 12.2% on books, magazines, movies, TV, and most music.

- 12.5% / 10.35% on watches.

- 11.7% / 9.35% for most categories.

- 11.5% on collectible/trading cards.

- 10.7% / 8.35% for eBay Motors Automotive Tools & Supplies categories and most eBay Motors Parts & Accessories categories.

- 9.5% / 7.35% for most Musical Instruments & Gear categories.

- 8.7% / 6.35% for most Cameras & Photo categories, most cell phones and memory cards, most Computers/Tablets & Networking categories, most consumer electronics, stamps, and most Video Games & Consoles categories (but NOT video games or consoles).

- 8.5% / 6.35% for DJ and pro audio equipment and for paper money and coins.

- 7% on bullion.

- 6.55% / 4.2% on video game consoles and most major computing devices like computers, tablets, and printers and many of their components.

- 5.85% / 3.5% on guitars and basses.

- 5% on NFTs.

- 2.5% / 1.5% on some Business & Industrial categories, like heavy equipment.

- 0% on athletic shoes with a starting price of at least $100.

With an Anchor or Enterprise Store:

- Maximum final value fee of $250 on all categories (non-managed payments sellers only).

- Otherwise, the same as Basic and Premium stores.

The final value fee discounts can make a Store pretty tempting, and they will often save you a lot of money. Just make sure you know exactly when an eBay Store is worth the cost before shelling out your hard-earned money.

If you're selling cars on eBay, note that vehicles have their own special fees rather than final value fees. Some other listing types, like real estate, also have unique fee structures.

Customer Service Affects Final Value Fees

If you offer a great customer experience, you can become a Top Rated Seller and get 10% off your final value fees. (E.g., if you normally paid 12.55%, you'd pay 11.295% instead.)

But eBay knows people are only motivated so far by carrots. They also have a stick: if you drop below their seller performance standards, you'll get an extra 5% slapped on top of your final value fees (whether or not you use managed payments). They'll also nail you with the extra 5% in categories where your rate of "Item not as described" claims reaches "Very High," even if you're an above-standard seller.

Thankfully, these extra fees don't stack. You won't have to pay an extra 10% if both situations apply. But, the results are still really bad.

If you have one of these penalties, that means that if you normally paid 12.55%, you'd pay 17.55% instead.

Worse, this extra fee ignores caps and reduced-fee thresholds! That makes it equally bad regardless of whether you use managed payments or sell high- or low-value items. Here's how it can play out:

- Non-managed payments: If you sold something worth $10,000, your normal 10.2% would stop at $750 as if it had only been worth $7,353. However, the 5% penalty would be charged on the whole thing for an extra $500 in avoidable fees.

- Managed payments: If you sold an antique worth $10,000, you would normally pay 12.55% on the first $7,500, and then just 2.35% on the last $2,500. Your total fee should be exactly $1,000. But with the extra 5%, you'd pay $1,500 instead!

Those are some high stakes! Take eBay customer service seriously, be honest, and ship on time to keep your final value fees affordable.

Insertion Fees (eBay's Flat Fees)

Short version: If you list a lot of items, you may need to pay an extra $0.35 or so for some of them.

Every eBay seller gets to list a number of items every month without paying insertion fees. For most categories, these are as follows:

- No eBay Store: 250 items (with managed payments) or 200 items (without).

- With a Store (managed / not managed / both):

- Starter Store: 250 listings total between fixed-price and qualifying auction listings.

- Basic Store: 1,000 fixed-price items, plus 10,000 additional in select categories. / 350 fixed-price items. Plus, 250 qualifying auction listings.

- Premium Store: 10,000 fixed-price items, plus 50,000 additional in select categories. / 1,000 fixed-price items. Plus, 500 qualifying auction listings.

- Anchor Store: 25,000 fixed-price items, plus 75,000 additional in select categories. / 10,000 fixed-price items. Plus, 1,000 qualifying auction listings.

- Enterprise Store: 100,000 fixed-price items, plus 100,000 additional in select categories. / 100,000 fixed-price items. Plus, 2,500 qualifying auction listings.

Anything above those limits costs the following (these are the same with or without managed payments):

- No eBay Store: $0.35 per listing.

- With a Store:

- Starter Store: $0.30 per listing.

- Basic Store: $0.25 per listing.

- Premium Store: $0.15 per auction, $0.10 per fixed-price listing.

- Anchor Store: $0.10 per auction, $0.05 per fixed-price listing.

- Enterprise Store: $0.10 per auction, $0.05 per fixed-price listing.

Now, you might be wondering why you get so few free auctions. Don’t sweat it. If your auction succeeds and the item sells, eBay will refund your insertion fee (as long as it isn’t in an excluded category).

They’ll also refund insertion fees on fixed-priced listings if they sell and the buyer doesn’t pay up.

For some categories (mainly big-picture stuff like real estate and vehicles), there are no free listings. You are always required to pay an insertion fee. This fee can range to well over $100, and it's the same whether or not you use managed payments or have a Store.

Other eBay Fees

You can opt in to listing upgrades (managed / non-managed) for set-in-stone prices or Promoted Listings for a percentage of the sale. These can more than double the fees you pay, so use them wisely!

Shipping and Handling

Short version: Decide how much you’ll charge for shipping, because this charge counts toward your final value fee.

Now you know what eBay’s going to charge you... sort of. eBay will also charge its final value fee on any shipping costs you charge. You therefore need to know how much shipping and handling will cost so you can get an accurate grasp of the fees you’ll need to pay.

For those of you offering free shipping, knowing these costs is even more important because you need to factor them into every price.

Either way, you can’t really understand the cost of selling on eBay until you understand shipping and handling. Read our guide to shipping and handling costs to determine how much yours will run you.

PayPal, Managed Payments, or Other Payment Processing

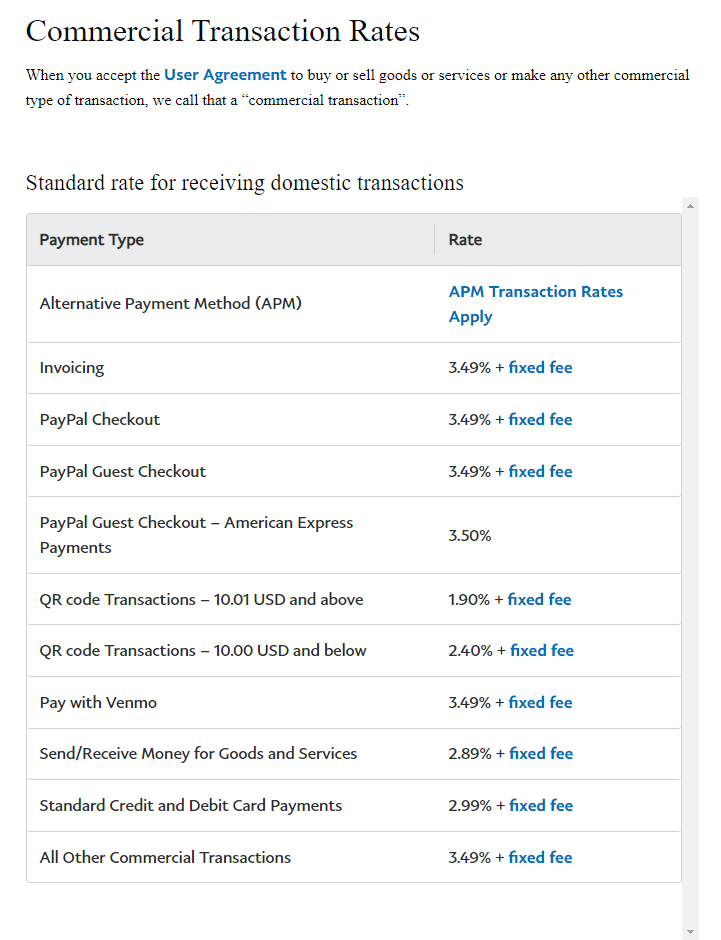

Below: 2021 PayPal fees.

Short version: Whether your payment processor is eBay, PayPal, or a credit card company, you can expect them to take a fixed fee and a percentage out of every transaction.

If you don't have managed payments, your payment processor's fees should be a major consideration.

PayPal and other payment systems like credit cards all have to make money somehow—typically through complicated fee structures of their own. These usually consist of both a percentage and a fixed fee per transaction. For example, PayPal fees for selling from one US location to another total 2.89% to 3.49%, plus $0.49 per transaction.

These fees are charged on the gross value of the transaction, before the final value fee and shipping costs are taken out. It’s therefore important to consider your payment processing fees before setting your final price.

If you use eBay-managed payments instead of accepting payments through PayPal, cards, etc., you will pay a higher final value fee than other sellers, as seen above. You will also have to pay a fixed fee of $0.30 per order—noticeably lower than PayPal's $0.49. The per-order fee and the increase in final value fees are both there to cover the payment processing cost.

When you look at the difference between eBay's final value fees with and without managed payments, you can see that it's usually 2.35% or less. This modest payment processing cost applies even if the customer pays through PayPal. The result is that it's always cheaper to use managed payments than to use PayPal.

So, if you've been looking at the higher final value fees with managed payments and feel like you're getting ripped off, don't worry. eBay is actually saving you a ton of money!

If you use managed payments, the only payment processing fee you have to keep track of is eBay's $0.30 per-order fee. If you use something else, like PayPal, you need to make a note of both the percentage fee and the per-order fee.

Note: If you accept multiple payment methods, compare the different fee structures for each and try to determine how much you’ll pay on average.

Sales Tax

Short version: While the buyer pays sales tax, any sales tax amount can increase your final value fees.

As of 2021, eBay charges and remits sales tax on behalf of sellers, at least in the US. You no longer have to panic about getting every sales tax license in the country to sell!

However, eBay does count sales tax in the total order value before applying their final value fee. So on sales where tax is applied, your final value fee will go up accordingly.

Sales tax varies by location. The US average state + local sales tax at the time of this article's last update is 6.35%.

That may be a reasonable number to use in your calculations, but you may want to check your sales history to find a more accurate average for your business. You may have much higher or lower taxes if your buyers are concentrated in specific states or cities. If you do, make a note of your sales tax percentage.

Advanced Final Value / Payment Processing Fee Calculation

Short version: If you want your customers to cover the cost of selling on eBay, calculate the price you will charge as "x" using the following system of equations: x = p + z + (y*q), x + (x*w) = q

Why You Need to Use Algebra

So, you know the final value fee is going to cost you 12.55% (or whatever happens to be the case). But you can’t just go slapping an extra 12.55% on your prices and expect that to cover the fee.

You also have to account for the impact of sales tax on your final value fee. But you can't just add an expected sales tax to your amount and then calculate the final value fee on that, either.

Say you plan to sell something for $40. You add eBay's $0.30 per order fee and get $40.30. Easy enough so far.

A 6.35% sales tax on $40.30 would be $2.56, bringing the amount to $42.86. The 12.55% final value fee on $42.86 is $5.38. So you should add that fee amount to $40.30, right? $45.68 will get you $40 on an average sale?

Wrong! The sales tax on $45.68 would be $2.90, and the final value fee on that $47.58 total would come to $5.97. Subtract that and eBay’s $0.30 per-order fee and you’re left with $39.41—still $0.59 short of your target of $40.

If you want to make sure that your price covers the final value fee and payment processing fee (both adjusted for sales tax), plus any other expenses, you need to use algebra.

Building Your System of Equations

First, add up all your fixed fees for selling one of your items. Start with any fixed payment processing fees. These include things like eBay's $0.30 or PayPal's $0.49 per transaction.

Next, add any other fixed fees, such as insertion and/or listing fees if this is a unique item. (These fees will be spread out across numerous sales if you’re using one listing to sell multiples of one product each month.)

The total value of all fixed fees above will be “z” in the formula below.

Next, tally any percentages charged on the sale price. This would generally be your final value fee and possibly a payment processing fee.

- For managed payments users, this should only be your final value fee, usually 12.55%.

- For most non-managed payments transactions, that means add PayPal’s 2.89% to 3.49% percentage to eBay’s 10.2% final value fee, for a total of 13.09% to 13.69%.

Use this percentage value as “y.” To use a percentage in a calculation, you need to divide it by 100. So if you have 12.55%, you would use 0.1255 as "y."

You should also account for any sales tax you expect, using it as “w.” Find your expected average sales tax percentage and divide it by 100. For example, if you expect an average sales tax of 6.35%, you should use 0.0635 as “w.”

Finally, determine how much you need to receive from each transaction in order to cover the costs of buying/manufacturing + shipping and handling the item while still making an acceptable profit. This value will be “p.”

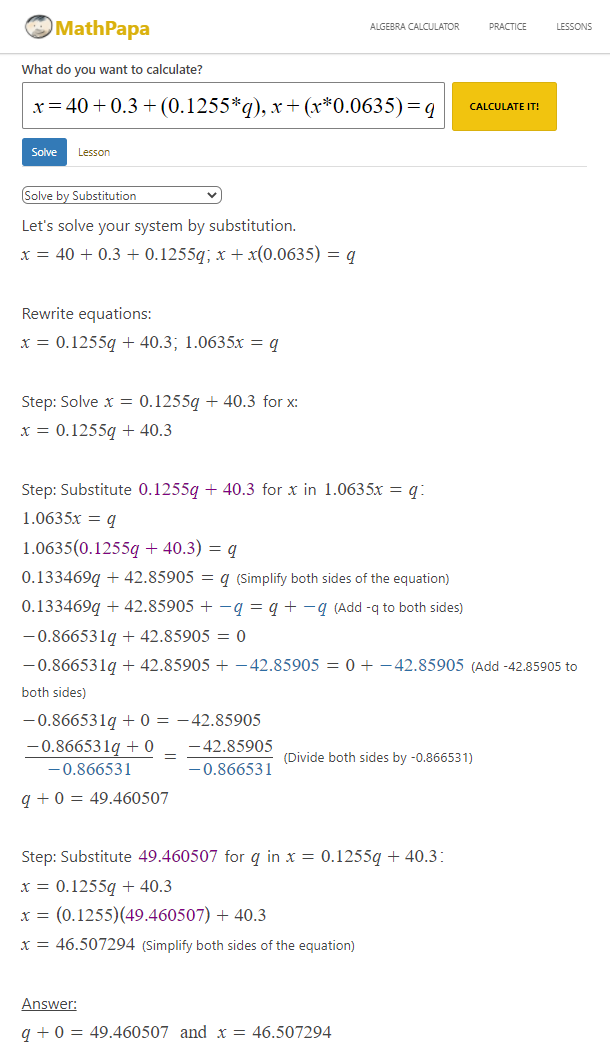

Now solve the system of equations below for “x” and “q.” “X” will be the amount you need to set as your listing price to get your minimum profit, and “q” will be the amount the customer is charged. You can solve this system easily by plugging it into an algebra calculator like MathPapa's.

x = p + z + (y*q), x + (x*w) = q

Example

Let's say I upload an item as one of my free monthly listings. Since I use managed payments, the only fixed fee I have to deal with is the $0.30 eBay fee per transaction. Therefore, I enter 0.3 as “z.”

My final value fee is 12.55%. Since I'm on managed payments, I don't have to worry about a PayPal percentage fee, but otherwise I'd add that percentage here. I therefore enter 0.1255 as “y.”

I decide to take the easy answer of 6.35% for sales tax and enter 0.0635 as “w.”

After adding up the cost of shipping and handling and the cost of buying the item I’m reselling, I determine that I need to receive an average of $40 after fees in order to cover my expenses and make an acceptable profit. I enter 40 as “p.”

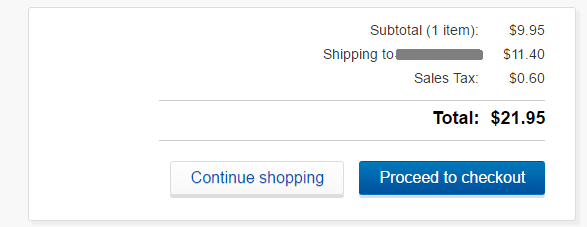

So the equation I get is: x = 40 + 0.3 + (0.1255*q), x + (x*0.0635) = q. After running that through an algebra calculator and rounding, I get $46.51 as “x” and $49.46 as “q.” So, I need to charge $46.51 to get my desired profits, and charging that means my customer will pay $49.46 on average.

Proof It Works

If I charge $46.51, a 6.35% tax on that would be $2.95.

2.95 + 46.51 = 49.46. So my charge plus the customer’s tax equals $49.46, just as the equation said. Good so far!

Now, eBay will charge its final value fee of 12.55% on the final amount (tax included) of $49.46. 12.55% of 49.46 is 6.21.

The amount I’ve actually received from the customer (tax not included) is $46.51. If I subtract that $6.21 fee, I get $40.30.

Finally, I remove eBay’s $0.30 per-order fee. That leaves me with a clean, even $40.

Using this formula will make sure you get exactly what you need out of every order, without guessing or overcharging.

Conclusion: What Does It Cost to Sell on eBay in Reality?

The real cost of selling a given item on eBay is made up of the following:

- The costs of making or buying the item you’re selling.

- The costs of packaging, handling, and shipping the item.

- Any fees you’re paying eBay and/or your payment processor for the transaction.

These costs are in addition to your overhead: customer service, government permit fees, paying freelancers to take photos or write descriptions for you, the opportunity cost involved in researching the item and dealing with suppliers, etc. Make sure your margins are healthy enough to cover these expenses as well.

We knocked our own costs way down by integrating eBay with a helpdesk. We highly recommend it if you want to stay in the black!

Now that you have your accounting under control, you can focus on the more exciting aspects of running an eBay business. Start by figuring out what to sell on eBay. Then learn how to get a great eBay feedback score so you can keep the sales coming in!